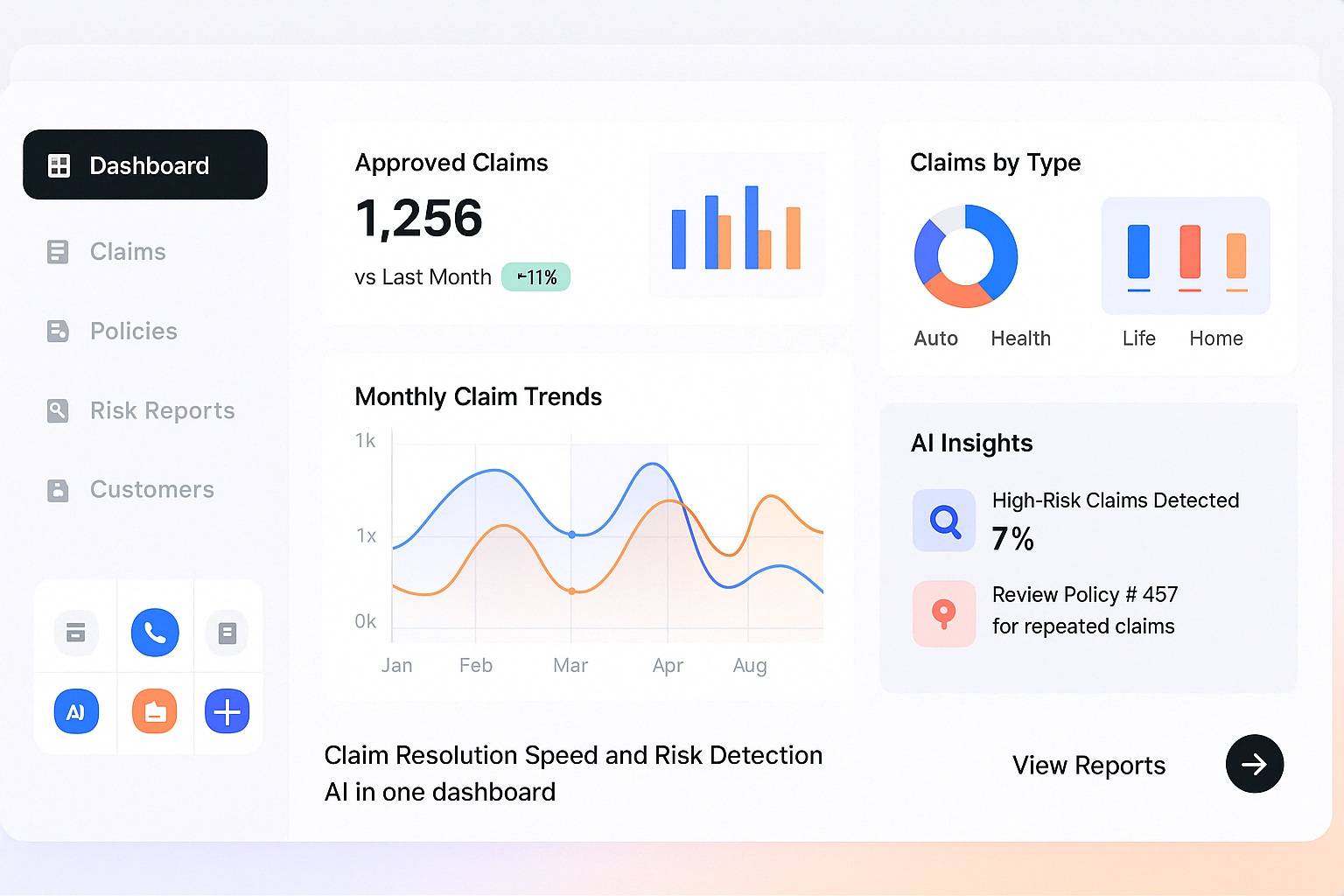

Business Intelligence & Analytics for Insurance

Automate Claims, Improve Risk Assessment, and Enhance Customer Experience and beyond with Livelytics AI!

The Insurance Industry is Evolving Fast, Livelytics Can Help you Cope-Up!

Efficient Claims Processing

Claims processing is often slow, complex, and prone to fraud. Livelytics, with its artificial intelligence, machine learning, and predictive analytics capabilities, changes the game by detecting inconsistencies and accelerating resolutions—ensuring faster, error-free claim approvals.

- Fraud Detection on Autopilot: Identifies fraudulent claims before they cause financial damage.

- Lightning-Fast Processing: Eliminates bottlenecks and speeds up claim resolutions.

- Flawless Accuracy: Reduces human errors, ensuring only legitimate claims are approved.

- Lower Operational Costs: Automates manual verification to save time and money.

Underwriting

Livelytics transforms the slow and error-prone process of traditional undert AI-driven precision, analyzing vast amounts of data, from policyholder details to market trends, to create accurate, bias-free risk assessments. This means faster approvals, smarter pricing, and fewer underwriting errors.

- Instant Approvals: This slashes underwriting time, expediting policy issuance.

- Risk Precision: AI-powered risk assessment leads to more accurate and profitable pricing.

- Error-Free Decisions: Reduces human miscalculations and inconsistencies.

- Maximized Profits: Helps insurers optimize risk management for stronger financial performance.

Claims Fraud Detection

Livelytics leverages AI-driven pattern recognition to detect anomalies in claims data, flagging suspicious activity before payouts occur. By analyzing claim history, policyholder behavior, and industry fraud patterns, insurers can prevent fraud before it impacts their bottom line.

- Automated Investigation: Reduces manual effort by instantly flagging suspicious claims for further review.

- Cost Savings: Prevents fraudulent payouts, saving insurers millions in potential losses.

- Strengthened Security: Provides a proactive approach to claim verification, ensuring only legitimate claims are processed.

- Customer Trust: Maintains transparency and fairness, ensuring honest policyholders aren’t affected by fraudulent activities.

Customer Retention & Churn Prediction

Livelytics analyzes historical customer behavior, claim frequency, and engagement levels to predict which policyholders are likely to cancel their policies. With these insights, insurers can implement personalized retention strategies to improve customer satisfaction and loyalty.

- Predictive Insights: AI-driven analytics help identify high-risk customers before they decide to switch providers.

- Improved Customer Experience: Helps insurers proactively address customer concerns, increasing satisfaction.

- Reduced Policy Cancellations: Enhances customer engagement to encourage long-term retention.

- Revenue Growth: Maintains a steady stream of loyal customers, reducing acquisition costs associated with replacing lost policyholders.

Regulatory Compliance

Livelytics automates compliance tracking to ensure compliance with industry regulations without drowning in paperwork. Livelytics’s AI-powered oversight, machine learning predictive intelligence, and real-time insights help insurance companies ensure compliance, avoid penalties, and achieve seamless operations.

- Risk-Free Operations: This minimizes exposure to fines and legal repercussions.

- Efficiency Boost: Streamlines compliance-related workflows for smoother operations.

- Always Up-to-Date: Keeps insurers aligned with ever-changing industry laws.

- Enhanced Transparency: Generates real-time compliance reports for audits and accountability.

Future-Proof Your Insurance Business with Livelytics!

Predict the risks and manage business processes - easily and accurately.

LivAI – Your Smart Data Assistant

With LivAI, you have a powerful, AI-driven insurance assistant at your fingertips. You can ask questions, generate insights, and access real-time reports to gain a deeper understanding of your business.

- Ask questions: Get real-time answers to complex insurance queries on the go.

- Automated Reports: Generate detailed reports on claims, customers, and trends effortlessly.

- Get updates & alerts: Through LivAI, get real-time alerts and updates on what’s happening for data-driven decisions.

End-to-End Data Security & Backup

Data privacy and security are top priorities in the insurance sector. Livelytics ensures that all sensitive user data, business insights, and customer records are fully encrypted, backed up, and compliant with industry regulations.

- Automatic Backups: Prevents data loss with secure, real-time backups.

- Regulatory Compliance: Ensures adherence to industry standards like GDPR and HIPAA.

- Data Access Control: Grants role-based access to prevent internal data misuse.

Integrations On-the-Go

Livelytics integrates effortlessly with your existing insurance systems, automating data collection, cleaning, transformation, and visualization for accurate, real-time insights that drive better decision-making with confidence.

- Effortless Data Flow: Automatically collects and processes data from various sources without disruption.

- Actionable Insights: Visualizes complex data for quick, informed decision-making.

- Future-Proof Predictions: Uses AI to identify trends and predict risks proactively.

Livelytics

Enhancing Insurance Excellence The Livelytics Way!

Livelytics makes Insurance smarter, faster, and more profitable with AI-driven insights and automation to streamline operations, boost efficiency, and maximize revenue.

Book a Free Demo

See more

Set Up & Personalize

See more

Get Actionable Insights

See more

Optimize & Scale

See more

Frequently Asked Questions

We offer two pricing plans tailored to meet the diverse needs of insurance businesses.

- Our Standard Plan is priced at $299 per month, with an additional user fee of $10 per user per month. It includes essential marketing tools along with three AI-powered insights.

- Our Premium Plan is available at $599 per month with the same additional user fee. This plan provides access to advanced marketing tools and six AI-powered insights.

By automating repetitive tasks and streamlining workflows, Livelytics AI reduces manual labor, streamlines processing, minimizes costly errors, and much more, leading to cost savings and improved profitability.

Absolutely. Our dedicated support team offers comprehensive support and training services to get you started and maximize the value of our platform.

LivAI is Livelytics’ smart data assistant that allows insurers to ask questions, generate insights, and create real-time reports, enabling faster and more informed decision-making.

Livelytics is designed for seamless integration, and our team provides full support to get you up and running quickly. Book your free demo & get started quickly.

Livelytics implements robust data backup and disaster recovery procedures to ensure data availability and continuity with regular backups and data redundancy measures to safeguard against data loss.

Transform Your Insurance Business with Livelytics!

Say goodbye to slow claims processing, outdated risk assessments, and manual data crunching. With Livelytics, you get access to AI-powered automation and predictive intelligence - so you can make smarter decisions, faster.

Book a Demo